Finding a way to pay for college can seem challenging, but it doesn’t have to be. At Northwest, we help students find the resources they need to make college affordable. We'll walk you through this process.

Bearcat Advantage criteria have changed from $8,392 for a specific segment to $8,728 for anyone out-of-state with a 2.75 GPA and above.

Traditional four-year students can save $34,000 with this scholarship over four years.

This enhanced scholarship has expanded scholarship tiers that could save students as much as $6,000 annually. These scholarships are automatically awarded based on student merit when they apply.

Curious what your real cost will be to be a Bearcat? Find out with our Net Price Calculator — get an estimate of what YOU might pay after scholarships and financial aid.

The Northwest Promise covers 100% of tuition and fees for eligible students from families with an income of $65,000 or less.

Most Bearcats receive some form of scholarship or need-based aid after filing the FAFSA, making their educational goals more attainable. The 2025-26 FAFSA is officially open – apply today!

NOTE: 2024-2025 tuition and fees vary based on number of credit hours, academic program and other factors.

While paying for college may be challenging, Northwest offers nearly $25 million in scholarships and grants.

| In-State | Out-of-State | International |

|---|---|---|

| $25,545 | $33,936 | $34,716 |

| Business Program | CSIS Program | Other Programs |

|---|---|---|

| $10,484 | $10,443 | $9,399 |

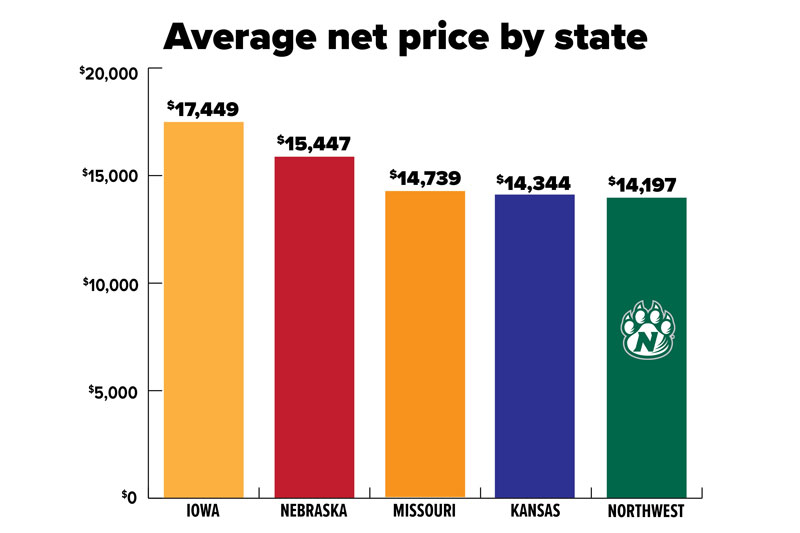

$14,197

First-year student net price (total for the whole year).

A net price is an estimate of the actual cost you and your family need to pay in a year to cover education expenses for you to attend a particular college or career school. It is the institution's cost of attendance minus any grants and scholarships for which you may be eligible.

Discover the scholarships that make your Northwest education even more affordable — because your hard work deserves to be rewarded.

A college degree can be worth millions throughout one’s career. For example, a study by the U.S. Census Bureau showed the lifetime earnings of someone with a high school degree topped out, on average, at $1.2 million. A bachelor’s degree secured an average lifetime earnings of $2.1 million.

75% of bachelor’s degree holders vote compared to 52% of those with a high school diploma. Those with a bachelor’s degree are two times more likely to volunteer, and charitable contributions are 3.5 times higher than high school-educated peers.

People with degrees are more valued in their jobs than those who don't have one. If there is a need for a layoff, those with lower qualifications are targeted. Studies show during an economic recession, those with a high school diploma and fewer skills suffer job cuts.

College graduates have better self-reported health than high school graduates. Individuals with more education are less likely to report heart disease, high blood pressure, diabetes, anxiety and depression. Furthermore, individuals with more education are more likely to exercise, drink less alcohol and seek preventive health care when needed.