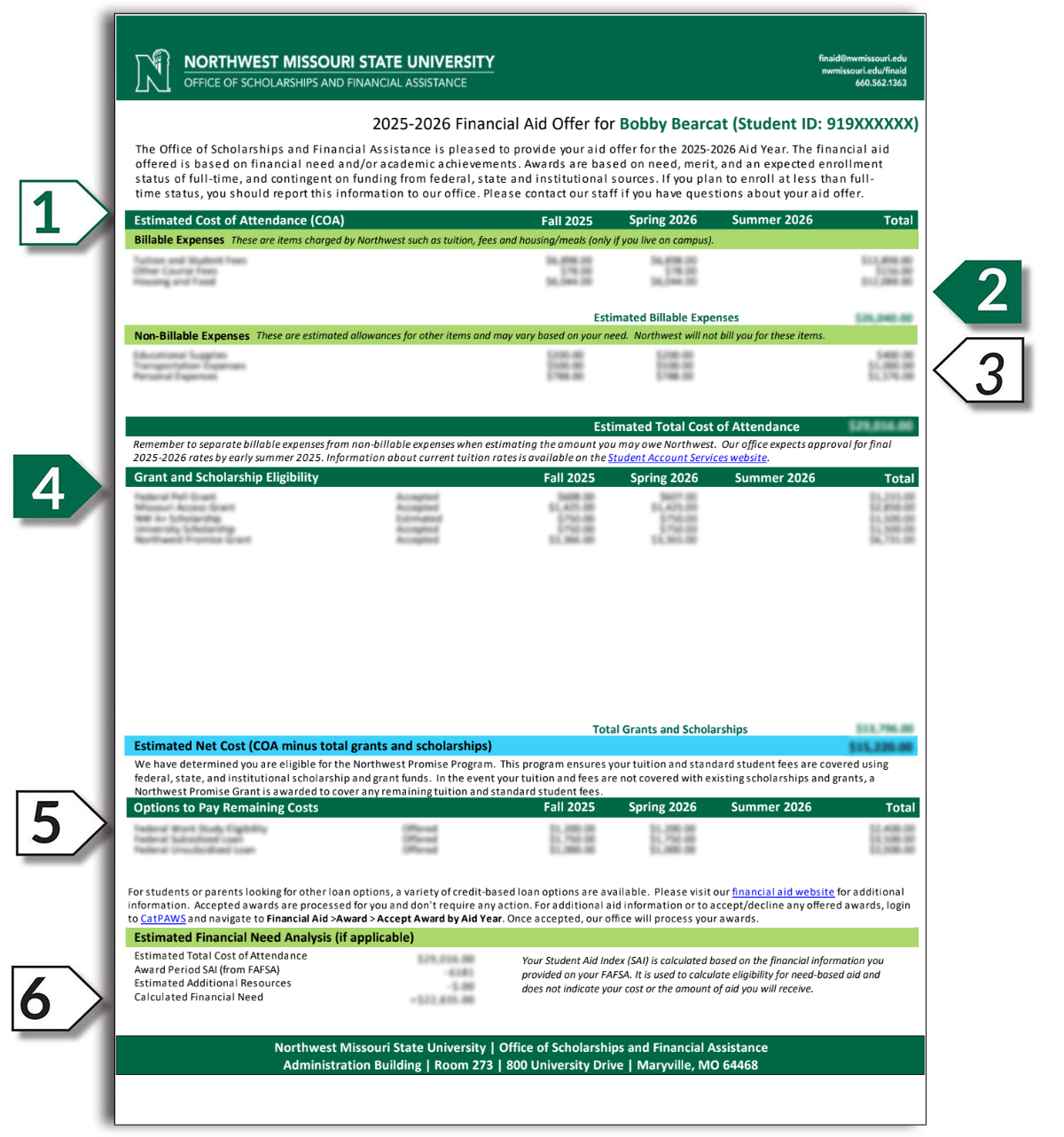

Your Financial Aid Offer lists all institutional scholarships, along with any federal and state aid offered to you to attend Northwest.

To view your Financial Aid Offer, you will need to:

|

|

| Keyword | Definition |

|---|---|

|

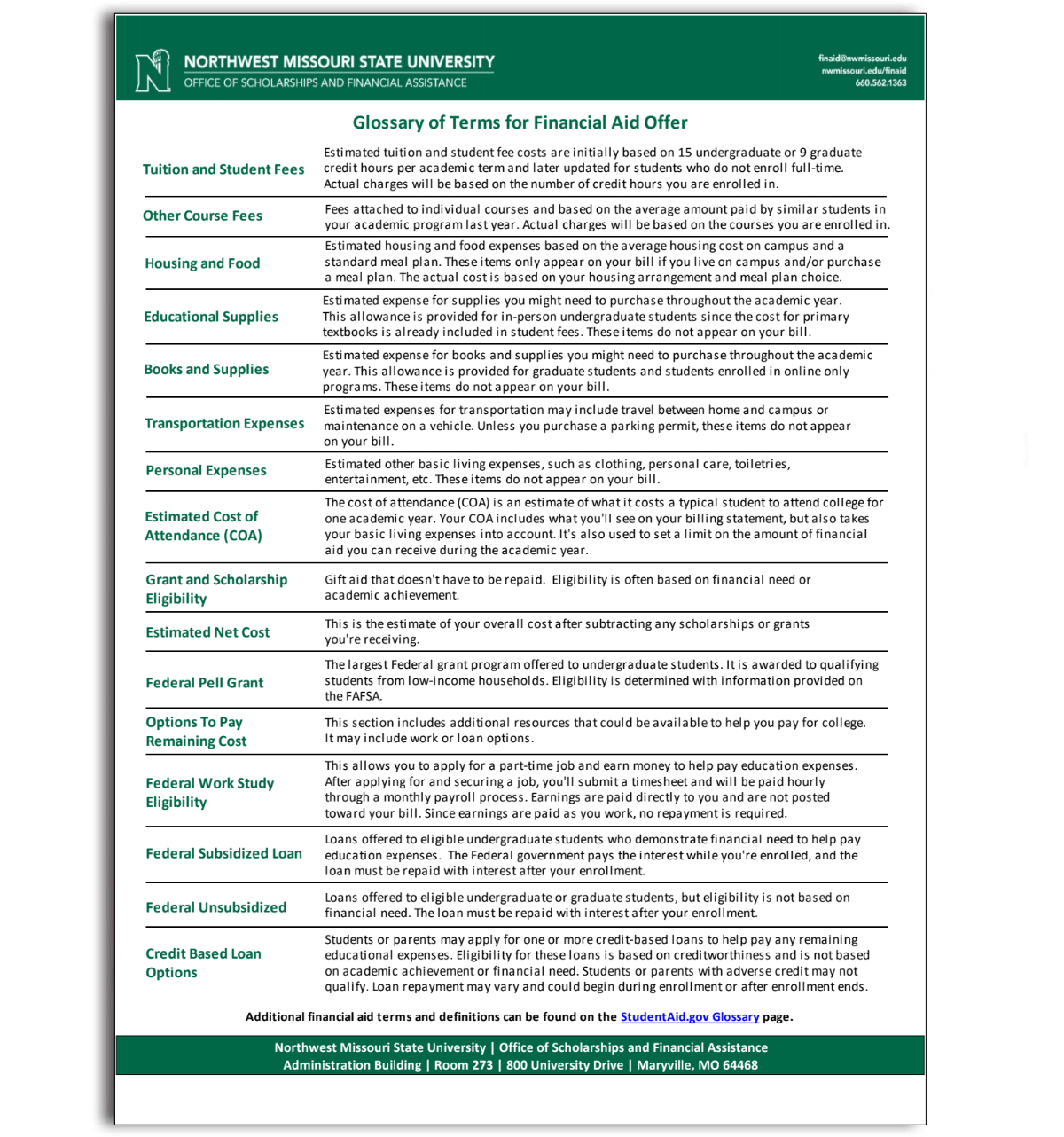

Tuition and Student Fees |

Estimated tuition and student fee costs are initially based on 15 undergraduate or 9 graduate credit hours per academic term and later updated for students who do not enroll full-time. Actual charges will be based on the number of credit hours you are enrolled in. |

|

Other Course Fees |

Fees attached to individual courses and based on the average amount paid by similar students in your academic program last year. Actual charges will be based on the courses you are enrolled in. |

|

Housing and Food |

Estimated housing and food expenses based on the average housing cost on campus and a standard meal plan. These items only appear on your bill if you live on campus and/or purchase a meal plan. The actual cost is based on your housing arrangement and meal plan choice. |

|

Educational Supplies |

Estimated expense for supplies you might need to purchase throughout the academic year. This allowance is provided for in‐person undergraduate students since the cost for primary textbooks is already included in student fees. These items do not appear on your bill. |

|

Books and Supplies |

Estimated expense for books and supplies you might need to purchase throughout the academic year. This allowance is provided for graduate students and students enrolled in online only programs. These items do not appear on your bill. |

|

Transportation Expenses |

Estimated expenses for transportation may include travel between home and campus or maintenance on a vehicle. Unless you purchase a parking permit, these items do not appear on your bill. |

|

Personal Expenses |

Estimated other basic living expenses, such as clothing, personal care, toiletries, entertainment, etc. These items do not appear on your bill. |

|

Estimated Cost of Attendance (COA) |

The cost of attendance (COA) is an estimate of what it costs a typical student to attend college for one academic year. Your COA includes what you'll see on your billing statement, but also takes your basic living expenses into account. It's also used to set a limit on the amount of financial aid you can receive during the academic year. |

|

Grant and Scholarship Eligibility |

Gift aid that doesn't have to be repaid. Eligibility is often based on financial need or academic achievement. |

|

Estimated Net Cost |

This is the estimate of your overall cost after subtracting any scholarships or grants you're receiving. |

|

Federal Pell Grant |

The largest Federal grant program offered to undergraduate students. It is awarded to qualifying students from low-income households. Eligibility is determined with information provided on the FAFSA. |

|

Options To Pay Remaining Cost |

This section includes additional resources that could be available to help you pay for college. It may include work or loan options. |

|

Federal Work Study Eligibility |

This allows you to apply for a part-time job and earn money to help pay education expenses. After applying for and securing a job, you'll submit a timesheet and will be paid hourly through a monthly payroll process. Earnings are paid directly to you and are not posted toward your bill. Since earnings are paid as you work, no repayment is required. |

|

Federal Subsidized Loan |

Loans offered to eligible undergraduate students who demonstrate financial need to help pay education expenses. The Federal government pays the interest while you're enrolled, and the loan must be repaid with interest after your enrollment. |

|

Parent PLUS/Credit Based Loan |

Loans offered to eligible undergraduate or graduate students, but eligibility is not based on financial need. The loan must be repaid with interest after your enrollment. |

|

Credit Based Loan Options |

Students or parents may apply for one or more credit-based loans to help pay any remaining educational expenses. Eligibility for these loans is based on creditworthiness and is not based on academic achievement or financial need. Students or parents with adverse credit may not qualify. Loan repayment may vary and could begin during enrollment or after enrollment ends. |

Additional financial aid terms and definitions, visit Glossary | Federal Student Aid.